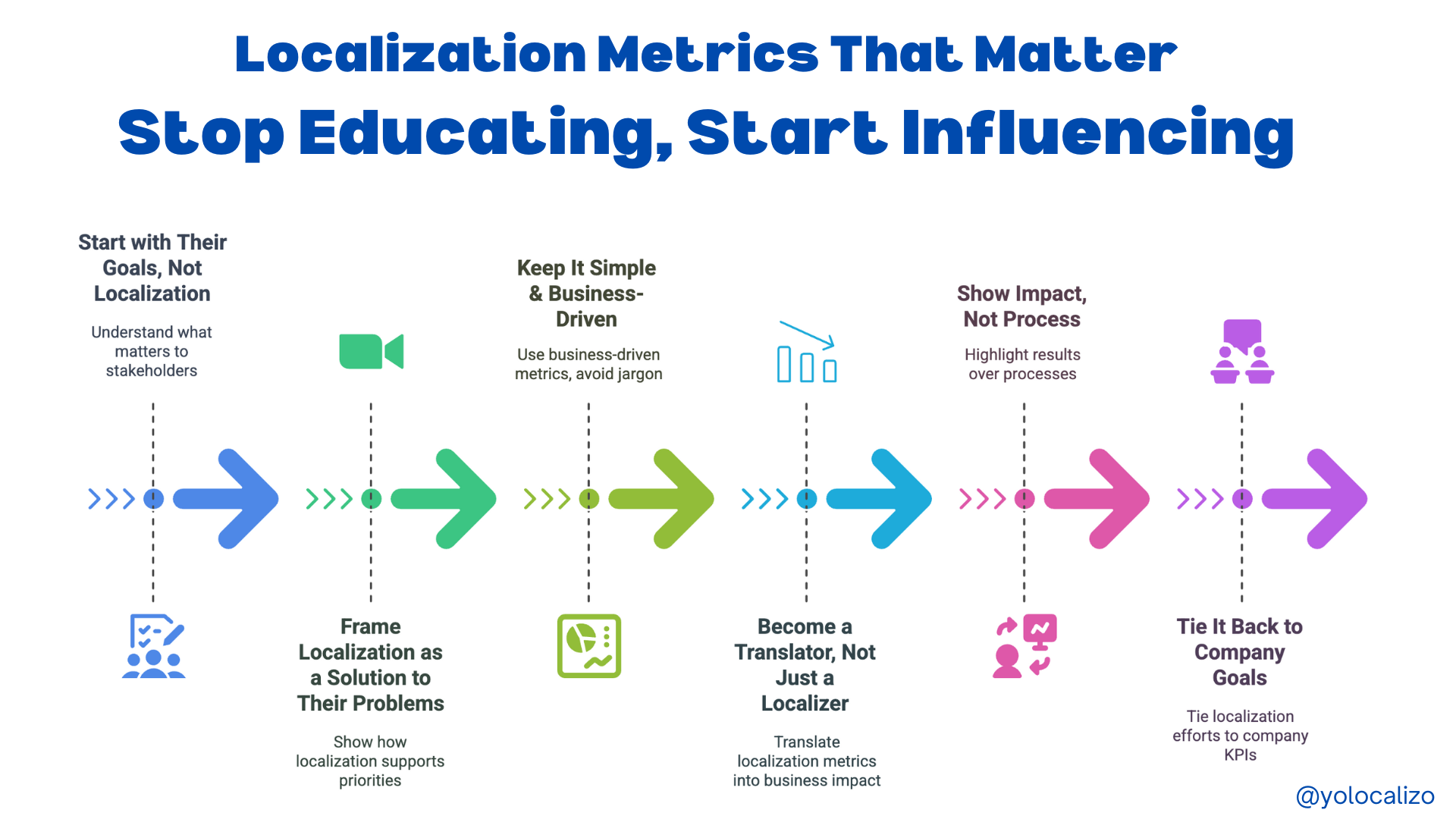

We all want Localization metrics, but where do we get them

A lot has been written about localization metrics and why they are important in pitching the importance of localization. Many, many words have been written about that topic, me included, as I have a few posts since I started this blog seven years ago that are related one way or another to metrics.

But actually, something very simple and important is what I had overlooked in all those articles. I had taken it for granted until earlier this week when I attended a panel on localization metrics. In that panel, we were talking about how to pitch the importance of those metrics and make a case for leadership… until someone mentioned something very eye-opening:

“I agree about the importance of pitching and preparing a case, but actually, where do I get that data?

How can I get access to the business metrics? I don’t have them, so where do I even start?”

That was an aha moment because one of the biggest challenges in localization isn’t just proving its value; it’s getting the data to do so!

I guess I’ve been lucky to have direct access to those numbers during my career, so this was kind of a black swan for me. I assumed everyone could easily access that data as well, which, obviously, like most assumptions, is a wrong assumption.

Everyone agrees that localization needs to show impact, but when it comes to actually getting the right metrics, many localization professionals face a challenge.

This post will help you navigate through these challenges. But before that, let’s go through some technicalities and definitions.

There Are Two Main Categories of Localization Metrics

Operational Metrics

A localization operational metric is a quantifiable performance indicator that a localization team directly controls and tracks to measure their processes' efficiency, quality, and effectiveness. These metrics are primarily focused on workflow, productivity, quality assurance, and cost management rather than business impact or revenue generation.

Key Characteristics of Operational Metrics:

Directly influenced by the localization team

Focused on process efficiency, quality, and cost

Typically sourced from internal tools like TMS, LQA platforms, and project management systems

Helps in identifying bottlenecks and improving workflows

Examples of Localization Operational Metrics:

Translation Volume – Number of words, strings, or segments translated per language.

Turnaround Time – How long it takes to complete localization for different content types.

LQA Error Rates – Frequency and severity of errors found during linguistic quality assurance.

Rework Rates – Percentage of translations that require modifications due to quality issues.

Stakeholder Review Cycles – Number of review iterations needed before approval.

Cost per Locale – Total localization spending per language or market.

On-time Delivery Rate – Percentage of projects delivered on schedule.

Consistency Score – Measurement of how well terminology and style guide adherence is maintained.

Automation Impact – Efficiency gained from using AI, MT, or automation tools.

Business Metrics

Then, we have business metrics.

Localization business metrics are impact-focused indicators that demonstrate how localization influences a company’s revenue, user engagement, and market growth. Unlike operational metrics, these are typically owned by other departments (e.g., product analytics, BI, marketing, finance) and require collaboration to access.

Examples of Localization Business Metrics:

Monthly Active Users (MAU) per market

Revenue per region

User retention per locale

The tricky part here is that these numbers are typically owned by product analytics, marketing, business intelligence (BI), or finance. And if you don’t have access, proving the impact of localization becomes an uphill battle.

But that doesn’t mean you’re stuck. This post is meant to give you some ideas about how you can start collecting meaningful data, even if you don’t have direct access to company-wide dashboards.

Click HERE to download the infographic

1.- Start With What You Can Track

Before trying to get revenue and user engagement data, ensure you’re tracking localization-specific KPIs you have access to. These are often operational metrics you can pull from your TMS, LQA efforts, and internal tracking:

Word counts & translation volume per language

Turnaround times for different locales

LQA error types & frequency

Rework rates (how often translations need fixing)

Stakeholder review cycles

Cost of localization per market

These will not directly impact revenue, but they can help establish efficiency gains and be leveraged when seeking deeper business insights.

Additionally, if your company uses tools like Google Analytics, Adobe Analytics, or ContentSquare, you may be able to analyze how localized content performs compared to the English version. Here are some key insights you can look for:

Traffic by country/locale – See how many users are engaging with your localized versions.

Bounce rate or time on page for localized content vs. English – If localized pages have higher engagement (lower bounce rates, longer session durations), that’s a strong indicator that localization is valuable.

Conversion rates in different markets – Compare how well-localized versions drive sign-ups, purchases, or other key actions.

User navigation behavior – Are localized users interacting differently with the content? Do they drop off at certain points?

Additionally, external data sources can supplement your analysis:

data.ai (formerly App Annie) – Provides market intelligence on mobile apps, including user engagement and revenue per country.

Statista – Offers industry reports and statistics on market trends, including regional gaming and app performance.

Nimdzi Insights – This company specializes in localization and globalization insights, including industry benchmarks that can help you frame localization’s value.

2.- How to Get Business Impact Metrics (or at Least Get Closer to Them)

-Find Your Allies

Ask PMs, producers, or product leads: “Do we track MAU or revenue by region or language?” They often work with BI and may already have reports.

Reach out to BI or data analysts: Frame your request in a way that aligns with business priorities.

Instead of saying, “I want localization data,” try this:

“I’d like to understand user behavior and revenue performance in localized markets to help prioritize future investments and support growth.”

This makes it clear that localization insights aren’t just for reporting, they help drive decision-making.

Start with What Exists

You may not need a custom report. Many teams already track data you can use:

Marketing teams may have campaign performance data by region.

Finance teams usually have revenue by market.

App stores (Google Play, Apple) show downloads, reviews, and revenue per country.

Game platforms (Steam, Xbox, PlayStation) provide regional performance metrics.

Even if data isn’t broken down by language, country-level insights can serve as a proxy.

3. Ask for a Slice (Not the Whole Cake)

When asking for business data, the key is to be strategic and realistic. Many teams are reluctant to share full dashboards or raw datasets due to data sensitivity, lack of time, or the perception that localization is a lower priority. Instead of overwhelming stakeholders with broad requests, narrow your focus to the most relevant and accessible insights. Start small and request a specific data slice that directly supports your localization goals. This approach makes it easier for teams to say yes and helps you build a foundation for future access.

Some targeted asks could be:

Top 5-10 markets by MAU or revenue – Identify where your localized content is making the most impact.

Growth trends before/after localization – Show if there’s a correlation between localization efforts and user engagement.

Performance comparison: localized vs. non-localized markets – Highlight how localized markets perform against those that rely only on the source language.

4. Build a Case Over Time

If direct access to business data isn’t an option right away, start by gathering the insights you can control. The goal is to connect qualitative and operational data to business outcomes, making it easier to advocate for deeper data access later. Instead of waiting for the perfect dataset, use what’s already available to tell a compelling story about localization’s impact.

Steps to start building your case:

Collect qualitative feedback. Look at user reviews, community feedback, and customer service tickets that mention language or localization issues. Patterns in this data can signal areas where better localization could drive engagement.

Track translation quality improvements – Use LQA scores, internal audits, and stakeholder feedback to show how localization quality has evolved.

Show efficiency gains – Track improvements in turnaround times, fewer revisions, and reduced rework rates to highlight operational success.

Use small wins to justify deeper data access later – Once you have evidence that localization influences user experience and efficiency, present these insights to data owners. A strong case backed by existing data makes it easier to request more business-driven metrics down the line.

Localization data advocacy is a long game. The more you integrate localization insights into business discussions, the easier it becomes to gain access to higher-level analytics that tie localization to growth and revenue.

Final Thoughts

Data access takes time. , but instead of waiting for the perfect dataset, start by tracking what you can control, building relationships with data owners, and aligning your requests with business needs.

Localization shouldn’t be seen as a cost center, and data is your key to changing that perception. The more you connect localization to business metrics, the more influence you’ll have in shaping strategy. But, before making that connection, we need to think carefully about where to get this data, something that, until earlier this week, I did not pay much attention

@yolocalizo

Localizability has always been a challenge small issues in source content often lead to big problems later in translation. In this post, I explore how AI is giving localization teams a powerful new way to improve source quality, reduce friction, and create better content for every market right from the start.